House rules.

"The Rest" Of The 1910 Income Tax Story

detailed by UM-Amherst Professor Emeritus Richard Wolff

https://www.youtube.com/watch?v=20XAS3ORhEg

U Mass Professor Emeritus Richard Wolff Provides Out-Of-The-Box Views

“Mediocre philosophy sells: It makes the half-literate… feel smart."

The rationale - universally understood and widely applauded -- was that those citizens "most able to pay tax should contribute to the common wellbeing according to their capacity."

At the outset, 96% of the citizenry paid no income tax.

Nada. Niente. Nihil. Zilch.

It was not long, however, before The 4% began its sustained effort (now more vigorous than ever) to shift the tax burden from "The Rich" to "the little guy."

This means two things.

First, there is less need for "The Rich" to pay taxes on behalf of The Common Good.

Even more significantly, shifting the burden onto "the non-rich" makes the working class and middle class allies of The 4%, conscripting "wage slaves" into an "existential" fight for lower taxes, a struggle that chiefly benefits the overlords.

Throughout this long, sordid history, "The Rich" continue to stoke anti-tax sentiment, ostensibly to minimize "mensch's" tributary burden while the true intent of "The 4%" is to minimize its own tax burden.

The wealthy, lest we forget, have more to gain than to lose from the collapse of social services. At least in the short run...

George Soros: On The Comming Class War In The United States

"Job Creators" are impervious to the plight of underlings, only thinking of their "inferiors" when -- periodically -- it becomes useful to minimize workers' compensation for operating "the levers and wheels" of The Economic Engine.

No matter how low taxes can go and still finance essential government services, a far greater percentage of the overall tax burden is now paid by "mensch."

Meanwhile "The 4%" laughs all the way to the bank.

Speaking of which...

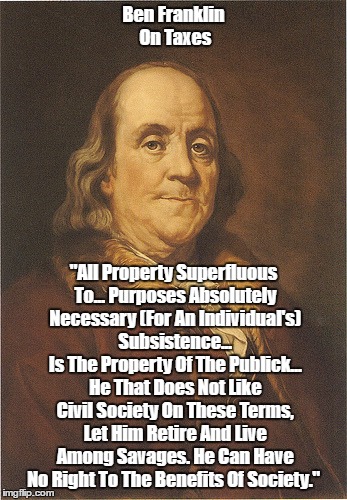

Benjamin Franklin to Robert Morris: On Taxes - 25 December, 1783

"The Remissness of our People in Paying Taxes is highly blameable; the Unwillingness to pay them is still more so. I see, in some Resolutions of Town Meetings, a Remonstrance against giving Congress a Power to take, as they call it, the People's Money out of their Pockets, tho' only to pay the Interest and Principal of Debts duly contracted. They seem to mistake the Point. Money, justly due from the People, is their Creditors' Money, and no longer the Money of the People, who, if they withold it, should be compell'd to pay by some Law. All Property, indeed, except the Savage's temporary Cabin, his Bow, his Matchcoat, and other little Acquisitions, absolutely necessary for his Subsistence, seems to me to be the Creature of public Convention. Hence the Public has the Right of Regulating Descents, and all other Conveyances of Property, and even of limiting the Quantity and the Uses of it. All the Property that is necessary to a Man, for the Conservation of the Individual and the Propagation of the Species, is his natural Right, which none can justly deprive him of: But all Property superfluous to such purposes is the Property of the Publick, who, by their Laws, have created it, and who may therefore by other Laws dispose of it, whenever the Welfare of the Publick shall demand such Disposition. He that does not like civil Society on these Terms, let him retire and live among Savages. He can have no right to the benefits of Society, who will not pay his Club towards the Support of it."

Billionaire Nick Hanauer's TED Talk: "Capitalism's Dirty Little Secret"

The Deep State Is Real: Plutocratic, Oligarchic, Unbridled Capitalism

"Politics And Economics: The 101 Courses You Wish You Had"

"Politics And Economics: The 101 Courses You Wish You Had"

"Plutocracy Triumphant"Cartoon Compendium

"War, Peace And Political Manipulation: Quotations"

"War, Peace And Political Manipulation: Quotations"

Taxes are the price we pay for civilization.

Most wealthy Americans

-- on whom the burden should rest --

refuse to pay enough tax to maintain healthy civilization.

Taxes are the price we pay for civilization.

Most wealthy Americans

-- on whom the burden should rest --

refuse to pay enough tax to maintain healthy civilization.

No comments:

Post a Comment