Billionaire Nick Hanauer's TED Talk: "Capitalism's Dirty Little Secret"

Is Kerala, India, A Successful Example Of Socialism In Action?

An Australian Video Spoof Goes To The Heart Of Unregulated "Cowboy" Capitalism And It's Pre-Legalized Criminality

“I think it's terrible the way people don't share things in this country. I think it's a heartless government that will let one baby be born owning a big piece of the country, the way I was born, and let another baby be born without owning anything. The least a government could do, it seems to me, is to divide things up fairly among the babies.” – Kurt Vonnegut, God Bless You, Mr. Rosewater

“Politics is a game played by the rich with the lives of the poor.” – J. Adam Snyder

“The Seattle Times reported in 2018 that the median net worth of white Seattleites is $456,000. The median net worth of black Seattleites—and here you should probably beep-boop-boop that therapist again—is $23,000. White net worth in my city is twenty times that of black net worth. If you are one of those people who believes that racism is a thing of the past, never existed at all, or is defined simply as one person being mean to another person, you are claiming that white people genuinely earn—through ability alone, because anything else would be a systemic advantage—twenty times as much as black people. White people are twenty times as good at their jobs, twenty times as skilled, twenty times as deserving. If you believe that, you are racist. That is racism.” - Lindy West https://en.wikipedia.org/

At our creative dialogue this coming Wednesday April 7, we will choose a theme for April. We’ll imagine a menu of options and then make our choice from the menu.

Several of our dialogue participants in Calgary had expressed interest in a Book Club. This could be done in any one of various ways. As one example, I will append my synopsis of a good book below, and (after we have chosen a theme for April) facilitate our dialogue on a topic related to the book. The topic for April 7 is Income Inequality: Causes, Consequences, and Remedies.

Please read the synopsis, and then consider the following questions:

· If someone said that people are simply paid what their contribution to society is worth, how would you respond to that person?

· Two other recently circulated synopses, one of Can’t Even: How Millennials Became the Burnout Generation (Anne Helen Petersen, 2020) and the other of The Impact of Inequality: How to make Sick Societies Healthier (Richard Wilkinson, 2005) deal with very closely related subjects. Using these and the book by Robert Reich, how might you interpret the recent news of violence and discord in the United States, beginning with the January 6 attack on the US Capitol building? If you were writing a commentary and including some suggestions about how to reduce such violence and discord in the future, what suggestions would you make?

· What books have you read recently that might help us understand and respond to these issues and challenges? Would you consider leading a creative dialogue on such a book?

· If you were going to lead a “Book Club Dialogue” this month or next on any book you have read recently, what book would that be?

Here is the Zoom link for our dialogue this coming Wednesday April 7:

Topic: Humainologie creative dialogue

Time: April 7, 2021 06:30 PM Mountain Time (US and Canada)

Every week on Wed, until Apr 28, 2021, 9 occurrence(s)

Join Zoom Meeting

Meeting ID:

Passcode:

Arthur

Book: (Robert Reich) Saving Capitalism: For the Many, Not the Few (2015)

In this landmark national bestseller Robert Reich provides a roadmap https://www.youtube.com/watch?

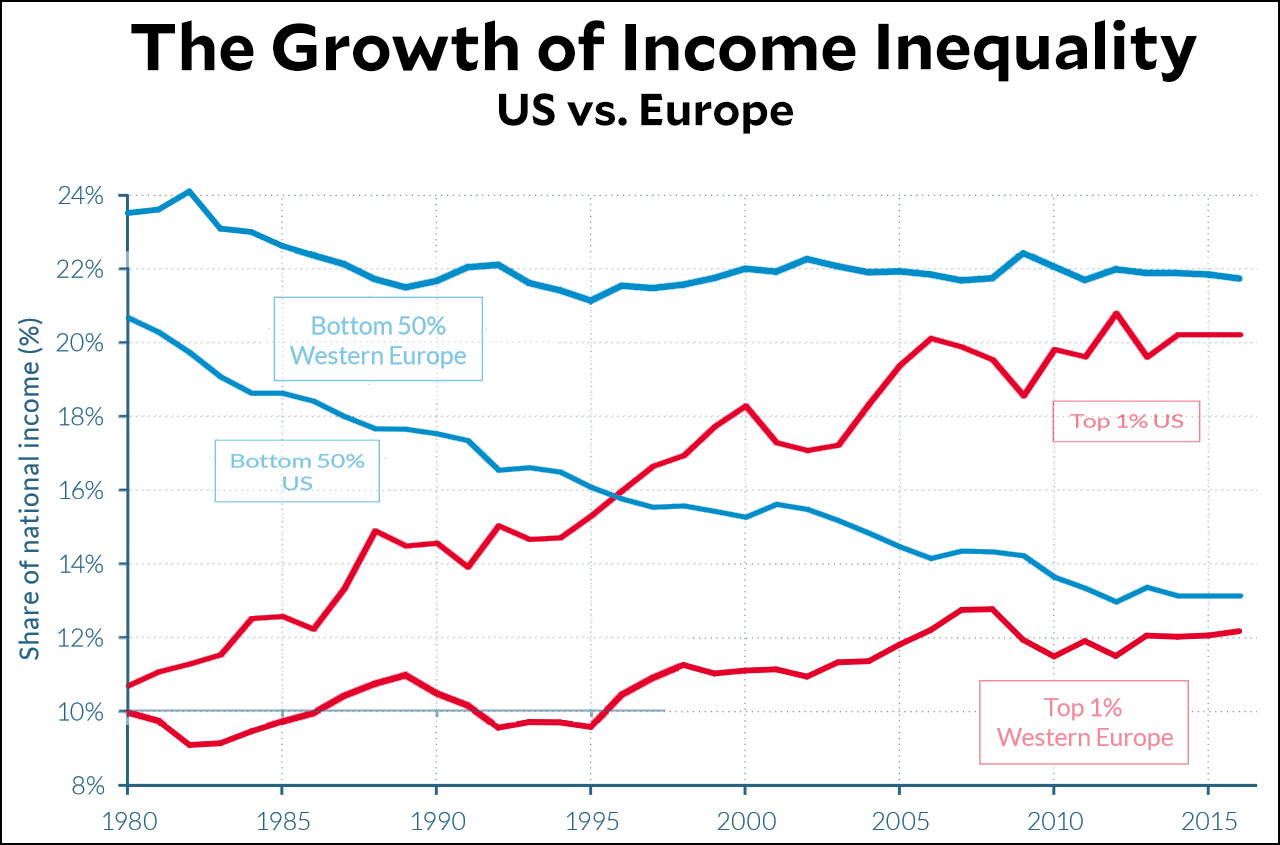

During the thirty years following World War II, the American economy doubled in size and so did the earnings of the typical American worker. “Then, the economy generated hope. Hard work paid off, education was the means toward upward mobility, those who contributed most reaped the largest rewards, economic growth created more and better jobs, the living standards of most people improved throughout their working lives, our children would enjoy better lives than we had, and the rules of the game were basically fair.” After that, things changed. In the three decades after 1975, “the size of the American economy doubled again but the earnings of the typical American worker went nowhere.”

Numbers from a study published in 2014 illustrate the point. They compare the wealthiest households (top10%) in America with the less wealthy (bottom 90%) households, in terms of how the benefits of economic expansion were distributed. Between 1949 and 1953, the economy expanded, and the wealthiest households (top 10%) got 20% of that, while the less wealthy 90% of households received 80% of the growth. With each subsequent expansion, the richest 10% got a larger and larger piece of the pie. In the economic expansion of 2001-2007, the top 10% received more than 95% of the gains, while the bottom 90% of households received less than 5%. It did not stop there. The expansion that followed the 2008 economic bust and bailout, 2009-2012, was the first in which the bottom 90% actually lost income, while the top 10% of households gained more than the amount of the expansion (see bar graph p. 162).

Such outcomes are not simply the result of impersonal “market forces.” Instead, as Reich makes clear, the so-called “free market” is in fact driven by decisions made by human beings. Specifically, decisions must be made about the rules that will govern five things: Property; Monopoly; Contract; Bankruptcy; and Enforcement. “Many of these decisions are far from obvious and some of them change over time, either because social values change (think of slavery), technologies change, …or the people with power to influence these decisions change…. These decisions don’t ‘intrude’ on the free market. They constitute the free market. Without them there is no market.”

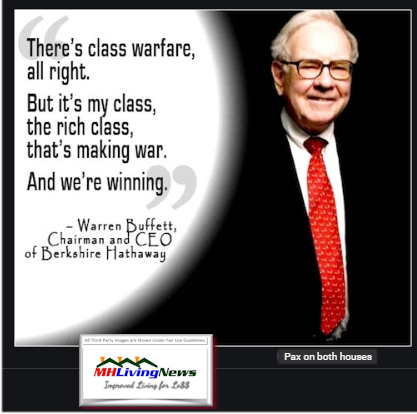

The endless debate about whether the “free market” should be allowed to operate on its own, or whether government should interfere with it, is a false debate. It creates theater to distract us, while the super-rich manipulate the rules to increase their personal wealth. As Reich shows in detail, they manipulate the rules through political influence. To restore a basic fairness to the “rules of the game” will not be easy. “The challenge is not just economic but political. The two realms cannot be separated. Indeed,” Reich emphasizes, “the field on which I draw in this book used to be called ‘political economy’ – the study of how a society’s laws and political institutions relate to a set of moral ideals, of which a fair distribution of income and wealth was a central topic.”

The super-rich are not evil, Reich emphasizes – and he mentions specifically, with praise, the Bill and Melinda Gates Foundation – but as a group they work in their individual self-interest; and the aggregate effects of this will create socioeconomic conditions that drive countless people into desperate straits. The “free market” is a myth. The myth is useful to those who want to control the “free market” for their own purposes (such as maximizing their personal wealth). “My conclusion,” writes the author, “is that the only way to reverse course is for the vast majority who now lack influence over the rules of the game to become organized and undivided, in order to re-establish the countervailing power that was the key to widespread prosperity five decades ago.”

One example of that countervailing power in the 1950s, was the American Legion. It “was largely responsible for passage of the GI Bill of 1944, which guaranteed every returning veteran up to four years of postsecondary school education, subsidized home mortgages, and business loans. The Legion was successful precisely because its divisions and chapters mobilized tens of thousands of members to pressure their own senators and representatives.” Labor unions were promoting economic security for working families and individuals; and there was the even greater impact of the federal government’s New Deal and other programs “in creating new centers of economic power that offset the power of the giant corporations and Wall Street.”

Political scientists found that the effectiveness of democracy in those days derived from the fact that “even though the voices of individual Americans counted for little, most people belonged to a variety of interest groups and membership organizations – clubs, associations, political parties, and trade unions – to which politicians were responsive. ‘Interest-group pluralism,’ as it was then called, did not conform to the old textbook models of direct or even representative democracy. But it was responsive to the needs and aspirations of most citizens.” Unfortunately, “By the 1980s, the vast mosaic of organizations that had given force and meaning to American pluralism was coming apart. By the first decades of the twenty-first century, many of these organizations had all but disappeared, as had their collective voices.” They were replaced by ”national advocacy organizations” that are far less effective.

In chapter 17, “The Threat to Capitalism,” the author emphasizes that “an economy is based on trust. The cumulative effect of even small violations of trust can generate huge costs.” Conversely, he shows how providing the working people in our society with a good income will boost economic growth even as it builds trust. Therefore, there are compelling reasons, if we want to save capitalism at all, to restore countervailing power. In chapter 19, “Restoring Countervailing Power,” he points out that in fact this change would also be in the best interests of the top 10% because “they will do better with a smaller share of a faster-growing economy whose participants enjoy more of the gains and will be more secure in an inclusive society whose citizens feel they are being heard….”

Specific rule changes to aim for include creating a universal basic income. Another idea of the many he suggests is to make corporate tax rates dependent upon the ratio of CEO pay to the pay of the median worker in the firm. As that ratio goes up, so do the taxes on that corporation. In conclusion, he writes that if we want such outcomes, we “must understand what is happening and where [our] interests lie, and [we] must join together. We have done so before. If history is any guide and common sense has any sway, we will do so again.”

Link to blow-up of the image above: https://www.surveycool.com/wp-content/uploads/2019/01/Income-Inequality-in-the-US-in-2019-V3.jpg

Link to blow-up of the image above: https://i.redd.it/qpdrgowgr9a51.png

No comments:

Post a Comment