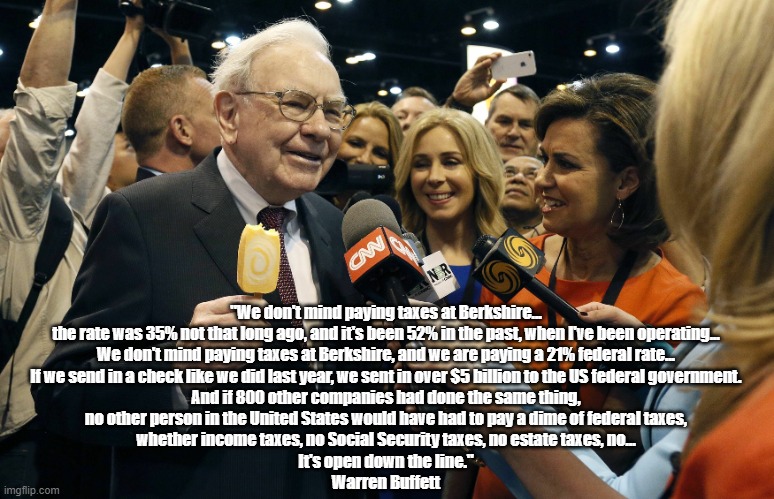

Fact Checked By Snopes: Warren Buffett Says If Just 800 Other American Companies Paid The Same 21% Tax Rate That His Company, "Berkshire Hathaway," Pays, There Would Be NO Need For Any Individual American To Pay Any Federal Income Tax, Or Any Social Security Tax, Or Any...

https://www.youtube.com/watch?v=VJzTsTU1xL8

The Warren Buffet video clip above begs our continual attention.

In this clip, Buffett cuts to the heart of the perennial scam perped by the ultra-wealthy to keep "The 99%" shackled to the treadmill, while The 1% laughs all the way to the bank.

If we were to focus on Buffett's expose' of America's core revelation about taxation with the same dedication that Trump cultists stay focused on Malignant Messiah's incessant bilge, the ongoing ruse of The Ruling Class's dominance/submission bondage would come to a prompt end.

It is close to God's Truth to say that Everything Else - that any other analysis of America's quandary - is so much damaging distraction that impels us to collude with our perpetual overlords.

Never forget... "The 1% is smart enough to know that you are dumb enough to applaud your own oppression."

Personally, I do not need more wealth.

But, in order to escape from demeaning poverty most of the world does.

By Uncle Sam's definition, 11.5% of the population lives in poverty.

Who knows how many more Americans are having real trouble making ends meet?

I think it is likely that the lion's share of the 45% of Americans who back Trump are economically and spiritually impoverished. Deliberately demeaned by the plutocracy and then persuaded to fight with one another rather than see "what's going on."

A strategical note for those who want Warren Buffett's insight to be universally adopted ...

Bernie Sanders' bedrock strength as a politician is his ability to "stay on task," never allowing himself to be distracted.

Bernie's unfailing dedication to Job 1 needs to be our unfailing dedication to Job 1.

Even the Dunning-Kruger dimwits can understand Buffett's simple-dimple message...

... if they hear it as often as they hear the bilge on Fox News.

Be relentless in spreading the word.

It's The 1% stupid!

*****

N.B. Warren Buffett is America's most successful "pure" capitalist, which is to say, he makes ALL his money by "moving money."

Throughout his work day, Warren sits in his office, shunting money about on a computer screen.

That's it.

That's the entire, purely capitalist game.

Income Tax means nothing to The Ruling Class, which is entirely about accumulating non-taxable wealth.

What does "non-taxable wealth" mean"?

Here's how it works...

The Ultra-Wealthy keep their riches in the form of stocks, bonds and other financial "vehicles" that are "never" taxed, or at least they are never taxed until The Ungodly Rich sell their "shares," thus converting non-taxable income into taxable income.

However!

Members of the Ruling Class live their daily lives entirely off their taxable income -- in effect that minuscule trickle of income that qualifies as their "salary."

And so, they pay almost NO TAX in comparison to their net worth.

The deck has been stacked in such a way that those of us who are not ultra-rich have been led to believe (by unrelenting right-wing propaganda) that "balancing the national budget and providing a social net" is ALL ABOUT the income tax.

Ben Franklin On "No New Taxes" (And Other Taxation Surprises)

Understand this.

All Income Tax revenues (in the absence of wealth tax revenues and/or meaningful corporate taxes) are the equivalent of a single loogie floating on The Ocean of non-taxable Super-Wealth.

Consider.

Here is the very first answer to my Google inquiry, "What percentage of the Super Wealthy's riches are taxed as income?"

According to data from the EU Tax Observatory, the super rich, particularly global billionaires, often pay an extremely low effective tax rate on their wealth, sometimes as low as 0% to 0.5%, meaning a very small percentage of their overall wealth is taxed as income; this is largely due to the ability to avoid taxes on unrealized capital gains from assets like stocks and real estate.

Key points about the super rich and taxation:

- Studies show that the wealthiest individuals often pay a significantly lower effective tax rate than the average citizen, even though they may earn a large income.

- A major factor contributing to this low tax rate is that the super rich often don't pay taxes on the unrealized gains from their assets until they sell them, allowing them to defer taxes for long periods.

- Some argue that implementing a wealth tax, which directly taxes the value of an individual's assets, could help address this issue and ensure the ultra-wealthy contribute more proportionally to tax revenue.

Capitalism Is America (And The World's) Foremost Propellant Of Moral And Environmental Degradation (A Propellant That "The Deep State" Renders Nearly Invisible)

https://newsfrombarbaria.blogspot.com/2024/02/capitalism-is-america-and-worlds.html

Cowboy Capitalism Dependably Degrades -- And Often Ruins -- The Lives Of The People It Marginalizes, While Persistently -- Eagerly -- Trashing The Biosphere: An Updated Compendium

Here's all you need to know:

Fact Checked By Snopes: Warren Buffett Says If Just 800 Other American Companies Paid The Same 21% Tax Rate That His Company, "Berkshire Hathaway," Pays, There Would Be NO Need For Any Individual American To Pay Any Federal Income Tax, Or Any Social Security Tax, Or Any...

It's a total scam, folks.

A TOTAL scam.

One incident -- The Trump University Scam -- highlights the overarching Truth...

No comments:

Post a Comment